As the crypto landscape evolves, hybrid crypto exchanges are emerging as the frontrunners. Why is this transformation happening?

The world of cryptocurrency is ever-evolving, and with it comes the need for secure and efficient trading platforms. Enter hybrid crypto exchanges, a blend of the best features from both centralized and decentralized models. But what makes them the go-to choice for modern traders? Let’s start from the beginning 👇

What are cryptocurrency exchanges?

A cryptocurrency exchange, or a digital currency exchange, is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies.

Cryptocurrency exchanges are more than just platforms for trading digital currencies. They’re the heartbeat of the crypto ecosystem, dictating the pace, liquidity, and value of different cryptocurrencies.

Types of Crypto Exchanges: A Deep Dive

Centralized Crypto Exchanges (CEX): What is a centralized exchange?

Centralized exchanges, like Binance and Coinbase, are managed by single entities. They’re known for their user-friendly interfaces, custodial wallets, and comprehensive regulatory frameworks.

A centralized exchange functions similarly to a conventional stock market. Serving as an intermediary, they pair up buyers with sellers and are typically viewed as more secure and dependable than decentralized exchanges. This trust is evident as centralized exchanges dominate the market, handling 95% of all trades.

Features of Centralized Exchanges

Some of the features centralized exchanges hold are:

Convenient Mobile User Interface

They offer a user-friendly mobile interface for seamless trading on the go. This ensures that traders can access their accounts and execute trades anytime, anywhere, enhancing flexibility.

Custodial Wallet

A custodial wallet is defined as a wallet in which the private keys are held by a third party. This means that the third party has full control over your funds while you only have to give permission to send or receive payments.

They provide custodial wallets, ensuring that users’ assets are securely managed and stored. This offers peace of mind to users, knowing that their funds are in safe hands.

Order Book

With an order book system in place, users can view real-time buy and sell orders. This feature enhances transparency in trading, allowing users to make informed decisions based on market demand.

Banking Features

They incorporate banking features such as on/off ramps, payment with cards, and crypto credit cards. This facilitates easy fiat-to-crypto transactions, bridging the gap between traditional banking and the crypto world.

Augmented Convenience Features

Enhanced convenience features, including customer support and asset recovery, are integral to centralized exchanges. These features elevate the user experience, ensuring that users have the support they need when they need it.

Wide Accessibility

The platforms of centralized exchanges are designed for wide accessibility. Whether on the web, mobile, or browser extensions, users can easily access their accounts and trade across various devices.

Regulatory Framework

Adherence to a regulatory framework encompassing KYC, AML, GDPR, financial auditing, and insurance of funds is a hallmark of centralized exchanges. Regulated crypto exchanges need to comply with laws and maintain transparency in their financial operations. This contributes to the stability of the organization and the security of individual assets and data.

Faster and Cheaper than DEX

When it comes to speed and cost, centralized exchanges have an edge. Transactions are quick and at low cost as they dont need to use blockchain and different networks, they can batch transactions and produce more cost effective trading.

However, did you know that they control the private keys of the assets you deposit? When we look at centralized exchanges vs. decentralized exchanges, this is a certain stepback for centralized exchanges and a crucial pro for decentralized exchanges.

Decentralized Exchanges (DEX): What is a decentralized exchange?

A decentralized cryptocurrency exchange, known as DEX, stands in contrast to its centralized counterpart. It operates without a governing company, entity, or individual. Transactions on a DEX are direct peer-to-peer, devoid of intermediaries, and autonomously managed by algorithms termed smart contracts.

Platforms like Uniswap operate without a central authority. They prioritize security, allowing peer-to-peer trading and ensuring users retain control of their private keys. But while they offer unmatched security, they can sometimes be less intuitive for new users.

DEXes function on the foundation of blockchain technology and necessitate users to have cryptocurrency wallets to store their tokens. Before executing a transaction, these wallets must be linked to the exchange. On the other hand, centralized exchanges act similarly to banks, retaining your assets and ensuring their security.

The Features of decentralized exchanges

Let’s see some of the features of decentralized exchanges:

Non-custodial Wallet

They prioritize user autonomy by offering self-custodial wallets as no third party has access to the keys. This ensures that users have complete control over their private keys and assets, emphasizing full ownership and security.

Automated Market Maker (AMM)

They often employ automated market makers (AMM) to ensure liquidity. This system facilitates direct peer-to-peer trading, eliminating the need for intermediaries and enhancing the efficiency of trades.

Anonymous Trading

One of the standout features of decentralized exchanges is that there is no need for regulations which require KYC and identity revealing about who owns the wallet.

No Regulation

Operating outside the realm of traditional financial oversight, decentralized exchanges are not bound by standard regulations. This offers a level of freedom but also requires users to exercise caution and due diligence.

Decentralized and No Support for Users

The decentralized nature of these exchanges means they operate without a central governing body. As a result, they typically lack centralized customer support, placing the onus on users to navigate and resolve issues independently.

No Fiat On-ramp

Decentralized exchanges are primarily crypto-focused, meaning they often don’t facilitate direct fiat currency deposits or withdrawals. This can limit their accessibility for those looking to transition between traditional currencies and cryptocurrencies.

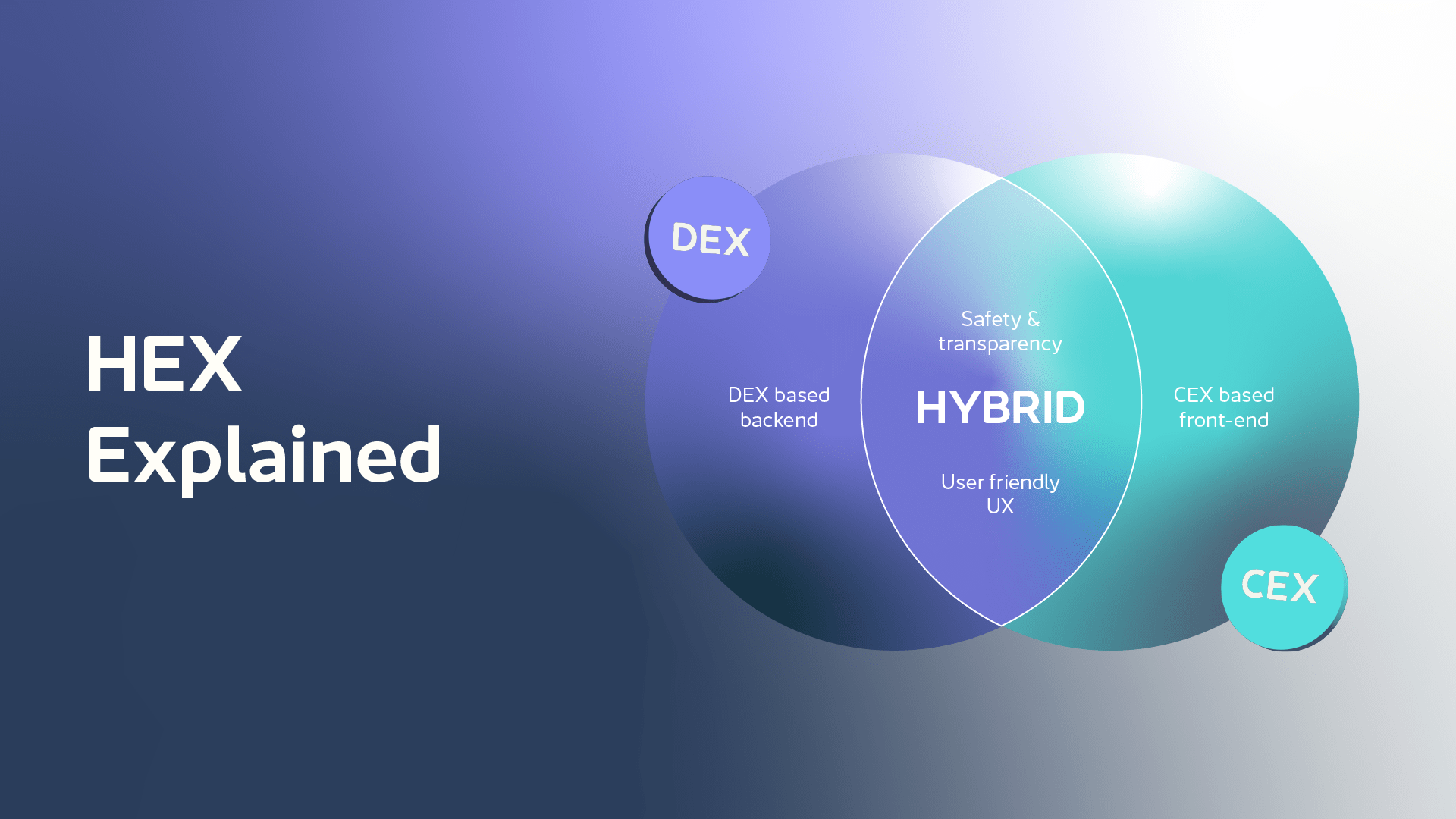

Hybrid Crypto Exchanges (HEX): What is a hybrid exchange?

Hibrīdās biržas apvieno funkcijas gan no CEX un DEX platformas.

Tās piedāvā lietotājiem autonomiju pār saviem aktīviem, kas līdzinās decentralizētām biržām, vienlaikus cenšoties panākt centralizētajām biržām raksturīgo ātrumu un lietošanas ērtumu. Turklāt tās ir izstrādātas, lai uzlabotu mērogojamību un samazinātu darījumu izmaksas.

Hibrīdās platformas izmanto glabāšanas mehānismu, lai aizsargātu aktīvus darījumu laikā, atspoguļojot centralizēto biržu likviditātes pieeju. Tas novērš decentralizētajām biržām raksturīgo nepieciešamību pēc lietotāja virzītas likviditātes, nodrošinot ātrāku darījumu veikšanu un novēršot augstās slīdēšanas maksas, ar kurām DEX saskaras zema tirdzniecības apjoma laikā.

Izmantojot blokķēdes tehnoloģiju, hibrīda biržas, ņemot vērā to priekšrocības salīdzinājumā ar parastajām decentralizētajām platformām, ir gatavas būtiski ietekmēt kriptovalūtu jomu turpmākajos gados.

Hibrīdās apmaiņas veidi

Pie hibrīdtirgu veidiem pieder rīkojumu grāmatas DEX, automātiskie tirgus uzturētāji (AMM) un DEX agregatori.

Pasūtījumu grāmatas DEXes

Rīkojumu grāmatas DEX hibrīdās biržās izmanto sistēmu, kurā pirkšanas un pārdošanas rīkojumi tiek uzskaitīti reāllaikā, ļaujot tirgotājiem tieši saskaņot ar pieejamajiem piedāvājumiem, nodrošinot tirdzniecības pārredzamību un dziļumu. Šī pieeja atspoguļo tradicionālās tirdzniecības platformas, bet darbojas decentralizētā vidē.

Automātiskie tirgus uzturētāji (AMM)

Automātiskie tirgus uzturētāji (AMM) hibrīda iestatījumos automātiski nosaka un koriģē kriptovalūtu cenas, pamatojoties uz matemātiskām formulām, tādējādi novēršot nepieciešamību pēc rīkojumu žurnāliem. Tas nodrošina pastāvīgu likviditāti un ļauj lietotājiem veikt tirdzniecību, negaidot darījuma partneri.

DEX agregatori

DEX agregatori darbojas, piesaistot likviditāti no dažādām decentralizētām biržām un optimizējot darījumus lietotājiem. Pārbaudot vairākas platformas, tie nodrošina, ka tirgotāji saņem vislabākās iespējamās likmes, un samazina slīdēšanu, kas bieži saistīta ar decentralizēto tirdzniecību.

Hibrīdās kriptogrāfijas biržas funkcijas

Hibrīda kriptogrāfijas biržu iezīmes ir šādas:

Ērta saskarne

Hibrīdās kriptogrāfijas biržas par prioritāti izvirza lietotāja pieredzi, piedāvājot lietotājam draudzīgu saskarni. Šī dizaina pieeja nodrošina, ka gan iesācēji, gan pieredzējuši tirgotāji var viegli orientēties un veikt darījumus.

Pašaprūpes maciņš

Līdzīgi kā DEX, arī tie par prioritāti izvirza lietotāja autonomiju, piedāvājot neaizsargātus makus, jo nevienai trešajai pusei nav piekļuves atslēgām. Tas nodrošina, ka lietotājiem ir pilnīga kontrole pār savām privātajām atslēgām un aktīviem, uzsverot pilnīgas īpašumtiesības un drošību.

Hibrīdmaiņu biržās drošība ir vissvarīgākā, un tās to uzsver, piedāvājot aizbildņu makus. Šī funkcija nodrošina, ka lietotāju aktīvi tiek glabāti droši, piedāvājot mieru tirdzniecības procesā.

DEX Trading

Viena no hibrīda platformu izcilākajām iezīmēm ir atbalsts DEX tirdzniecības metodēm. Neatkarīgi no tā, vai tās ir rīkojumu grāmatas, automatizētie tirgus uzturētāji (AMM) vai likviditātes apkopošana, hibrīdās biržas integrē šīs funkcijas, lai piedāvātu visaptverošu tirdzniecības pieredzi.

Regula

Hibrīdās apmaiņas sistēmās tiek atzīta uzticēšanās un drošības nozīme. Šajā nolūkā tās ievēro īpašus regulatīvos standartus, līdzsvarojot lietotāju autonomiju un atbilstību noteiktajām finanšu normām.

Banking Features

Hibrīdās biržas, kas savieno tradicionālo un kriptonaudu finanšu pasauli, ietver būtiskas banku funkcijas. Izmantojot tādus rīkus kā on-ramp, tās vienkāršo fiat-kripto darījumu procesu, atvieglojot lietotājiem pāreju starp dažādām finanšu sistēmām.

Visiem apmaiņas veidiem ir savi plusi un mīnusi, tāpat kā visam citam dzīvē! Tomēr CEX un DEX ir daži ierobežojumi salīdzinājumā ar HEX.

CEX un DEX ierobežojumi: kāpēc HEX ir nākotne

Lai gan CEX platformas ir lietotājam draudzīgas, tās bieži vien rada kompromisus drošības jomā. Savukārt DEX prioritāte ir drošība, taču tās var būt mazāk intuitīvas.

HEX platformas novērš šīs nepilnības, piedāvājot perfektu drošības, ērtības un likviditātes kombināciju. Pateicoties tādām funkcijām kā uzlabota lietotāju kontrole, stingri drošības pasākumi un plašs tirdzniecības iespēju klāsts, HEX platformas ir gatavas dominēt kriptovalūtu tirdzniecības jomā.

Salīdzinošā analīze: CEX vs. DEX vs. HEX

Lietotāja pieredze un ērtības: HEX platformas piedāvā intuitīvu, lietotājam draudzīgu pieredzi, tostarp klientu atbalstu, neapdraudot drošību.

Aktīvu kontrole un decentralizēta tirdzniecība: Atšķirībā no CEX platformām, kurās aktīvi tiek noguldīti, HEX nodrošina, ka lietotāji saglabā kontroli pār savām privātajām atslēgām, līdzīgi kā DEX.

Efektivitāte: HEX platformas apvieno CEX platformu ātrumu un DEX drošību, piedāvājot efektīvu un drošu tirdzniecību.

Banku funkcijas: HEX ietver fiat uz rampas un ārpus rampas, vienlaikus tiek regulēts un atbilst kā lielākā daļa finanšu iestāžu.

Šeit ir sniegts visu trīs apmaiņas veidu vispārējs salīdzinājums:

Priekšrocības

Centralizētas kriptogrāfijas biržas

- Atbalsta fiat un digitālās valūtas.

- Lietotājam draudzīgāks un stabilāks nekā DEX.

- Ir pieejams klientu atbalsts.

- Parasti ir zemākas darījumu komisijas maksas.

Decentralizētas kriptogrāfijas biržas

- Nav regulēta, un tas nozīmē lielāku brīvību.

- Nav jāveic identitātes pārbaudes, kas ļauj veikt anonīmu tirdzniecību.

- Mazāk pakļauti tirgus manipulācijām

- Drošāk.

Hibrīdās kriptogrāfijas biržas

- Supports fiat & digital currencies.

- More user-friendly than DEX.

- Better scalability than DEX, meaning fast processing even when large volumes of transactions take place.

- Less regulation than CEX.

- Security is enhanced by private ownership of the assets.

- More liquidity compared to DEX

Disadvantages

Centralizētas kriptogrāfijas biržas

- Custodial wallet, meaning assets do not belong to the users.

- No or few transparency of what is going on financially with the exchange or your assets.

- The size & nature of CEX makes it an easier target for hackers.

- Regulated by authorities and obliged to show any financial document when requested.

Decentralizētas kriptogrāfijas biržas

- Harder to get onboarded without prior knowledge about crypto.

- Do not support fiat transactions.

- Little to no support for users.

- Higher trading price compared to CEX

Hibrīdās kriptogrāfijas biržas

- Less privacy than DEX

Monitok: Leading the HEX Revolution

Monitok is a next-generation hybrid crypto exchange (HEX) that seamlessly integrates the advantages of both centralized and decentralized trading platforms. Offering a highly intuitive mobile app, Monitok ensures users have absolute control over their crypto assets, emphasizing full ownership and transparency. Monitok has no access to private keys and private keys/mnemonics are not leaving the app. Users have the option to store their private key on a piece of paper, or they can choose to store an encrypted version of the private key on their digital device or in the cloud for easier recovery.

The platform a mixture of features such as a built-in decentralized maku, encrypted private key recovery, two-step verification, and biometric sign-in. Traders can access over 100+ crypto tokens across 98 DEXes on the Arbitrum network, ensuring they always get the best rates with minimal fees.

Additionally, Monitok provides staking opportunities with attractive returns, peer-to-peer transfers, fiat on/off ramps, and a crypto debit card. With its commitment to combining flexibility, reliability, and user-centric features, Monitok is poised to set new standards in the crypto trading landscape.

Monitok is built with the future of hybrid trading in mind, because we believe that hybrid exchanges is the “next big thing” in crypto trading. Why? 👇

The Ripple Effect of HEX on Crypto

Hybrid exchanges are more than just platforms; they’re game-changers. They’re influencing trading strategies, liquidity management, and even the future evolution of crypto exchanges. As we look ahead, the importance and potential of HEX platforms in shaping the crypto world cannot be overstated.

With enhanced HEX liquidity solutions such as security, banking features, liquidity, regulations and user experience & convenience, they ensure optimal trading rates and swift transactions, making them appealing to a broad spectrum of traders.

Hybrid crypto exchanges are not just a trend; they’re the future. As the crypto world continues to evolve, these platforms are perfectly poised to lead the charge, offering traders the perfect blend of security and convenience.

Ready to dive into the world of HEX? Join us on our journey 👇

– Pievienojieties mūsu Discord kopienai

– Sekojiet līdzi jaunumiem Telegram

Biežāk uzdotie jautājumi

Centralized Exchanges (CEX): These are managed by centralized organizations or companies. They act as intermediaries between buyers and sellers, offering a platform for trading cryptocurrencies. Examples include Binance, Coinbase, and Kraken.

Decentralized Exchanges (DEX): These operate without a central authority and facilitate peer-to-peer trading directly between users. They rely on smart contracts and blockchain technology to automate and secure transactions. Examples include Uniswap, SushiSwap, and PancakeSwap.

Hybrid Exchanges (HEX): These combine features from both centralized and decentralized models. They aim to offer the security and user control of DEXs while providing the speed, liquidity, and user-friendly interface of CEXs.

A HEX blends the strengths of both CEX and DEX. Compared to centralized vs. decentralized exchanges, a HEX offers the user-friendliness and speed of a CEX while retaining the security and autonomy of a DEX. In decentralized vs hybrid exchanges, HEX provides enhanced liquidity and efficiency without sacrificing user control. And in centralized vs hybrid exchanges, while both offer a streamlined experience, HEX ensures greater user asset control and decentralized features.

Here are some examples of different types of crypto exchanges:

CEX: Binance, Coinbase, Kraken

DEX: Uniswap, SushiSwap, PancakeSwap

HEX: Monitok, GRVT, C3

Using a HEX offers the user-friendliness of CEX combined with the security of DEX. HEX ensures optimal trading rates, faster transactions, and greater user autonomy while often adhering to regulatory standards, making it a balanced choice for crypto trading.

They offer the convenience of CEX platforms and the security of DEX platforms, making them the ideal choice for modern traders.

Through features like self-custody, two-factor authentication, cold storage, compliance to regulations and regular security audits.

Most HEX platforms support a wide range of cryptocurrencies, offering traders immense flexibility.