In the heart of crypto lies the power of autonomy, and self-custody wallets are the vanguard of crypto trading – but, what are these self-custody wallets?

The prevailing wisdom among experts is, of course, to opt for self-custodial wallets; however, understanding the nuanced differences between self-custodial and custodial wallets is essential for making an informed decision.

Let’s elucidate the advantages of self-custodial wallets, provide guidance on how to get started, and offer compelling reasons for choosing them over their custodial counterparts.

How Does a Self-Custody Wallet Work?

Self-custodial crypto wallet refers to a digital wallet that grants you complete control over your cryptocurrency assets. Unlike traditional custodial wallets, where a third party manages your funds, self-custody wallets empower you to be the sole custodian of your crypto holdings. This direct ownership not only provides a greater sense of security but also aligns with the decentralized ethos of blockchain technology.

The workings of a self-custodial wallet are rooted in cryptographic principles. A cryptocurrency wallet serves as a digital interface for interacting with a blockchain network. It securely stores cryptographic keys—specifically, a public key and a private key—that are essential for authorizing transactions. The public key is analogous to an account number, accessible and visible on the blockchain, while the private key serves as a confidential authorization mechanism, akin to a personal identification number (PIN). These keys ensure that only the owner can access and control the funds, providing a robust layer of security.

Benefits of Self-Custodial Wallets

While some may prefer the convenience of custodial crypto services due to their simplicity, self-custodial wallets offer increased security and are in line with the core principles of decentralization.

You Control Your Keys

“Not your keys, not your crypto” is perhaps the most common and important phrase among self-custodial crypto users, and for a good reason. Usually, when you create an account with a centralized exchange, you’re given a custodial wallet. This means you won’t receive your private keys and cannot directly control or own assets within the wallet. Therefore, you’ll have to trust the platform controlling your funds.

Whereas with a self-custodial wallet, you receive your public and private keys. This means you have full control over the assets within the wallet, and no third party service can restrict or prevent transfers. The importance of owning your private key is clear: whoever has access to your keys has access to your crypto.

Eliminates Counterparty Vulnerabilities

Although the cryptocurrency market is adopting new regulations and laws to mitigate risk to consumers, there is always an element of uncertainty associated with 3rd party platforms. The collapse of the FTX exchange is a prime example of why you should always store your crypto in a self-custodial wallet. A custodial wallet involves a third-party service holding your private keys. In such a setup, the service provider has the ability to manage your assets, potentially making them vulnerable to unauthorized transactions or even malfeasance by the service provider itself. In contrast, with a self-custodial wallet, you have full control over your private keys, which means third-party providers cannot access or move your assets without your explicit authorization.

Reduced Costs

Self-custodial wallets offer a more cost-effective approach to asset management because they remove the need for intermediary financial institutions, such as a third party managing your keys. By enabling users to hold their own private keys, these wallets eliminate account maintenance fees and other charges typically levied by centralized services. Additionally, transactions can be executed directly from the wallet since they don’t require the involvement of third parties.

Immediate Transactions

Self-custodial wallets may also offer immediate transactions primarily because they give users direct control over their private keys and, by extension, their assets. This eliminates the need for third-party authorization, streamlining the transaction process. In contrast, custodial wallets involve an intermediary, such as a financial institution, which can introduce delays due to additional security checks or operational lags. Therefore, self-custodial wallets provide a more efficient avenue for immediate transactions.

Risks of Self-custodial wallet

The world of cryptocurrencies comes with its own set of challenges and rewards, and choosing a self-custodial wallet is a decision that shouldn’t be taken lightly. While these wallets offer greater control over your digital assets, they also come with their own set of risks that require vigilant management.

Private Key Loss

Misplacing your private keys means saying goodbye to accessing your funds. This often occurs among less experienced users who aren’t familiar with securing their private keys effectively. Unlike traditional banking systems, in very few cases there’s a ‘Forgot Password?’ option or customer service to bail you out. The decentralized nature of blockchain technology means you are solely responsible for safeguarding your private key. Lose it, and you’re effectively locked out of your own digital vault, with potentially significant financial consequences. Unless your A

Asset Theft

A self-custodial wallet is generally less susceptible to asset theft compared to a custodial wallet. However, the highest risk factor remains you, the owner, and your ability to securely manage your private keys. If a malicious individual gets hold of your private keys, whether by infiltrating your devices or stumbling upon your paper wallet, they can seize your digital assets, leaving you with little chance of retrieval. Despite the potential risks outlined, a self-custodial wallet remains the optimal choice for secure trading. By taking precautionary measures such as regular backups and strict security protocols, users can mitigate these risks and enjoy a higher level of control and ownership over their digital assets.

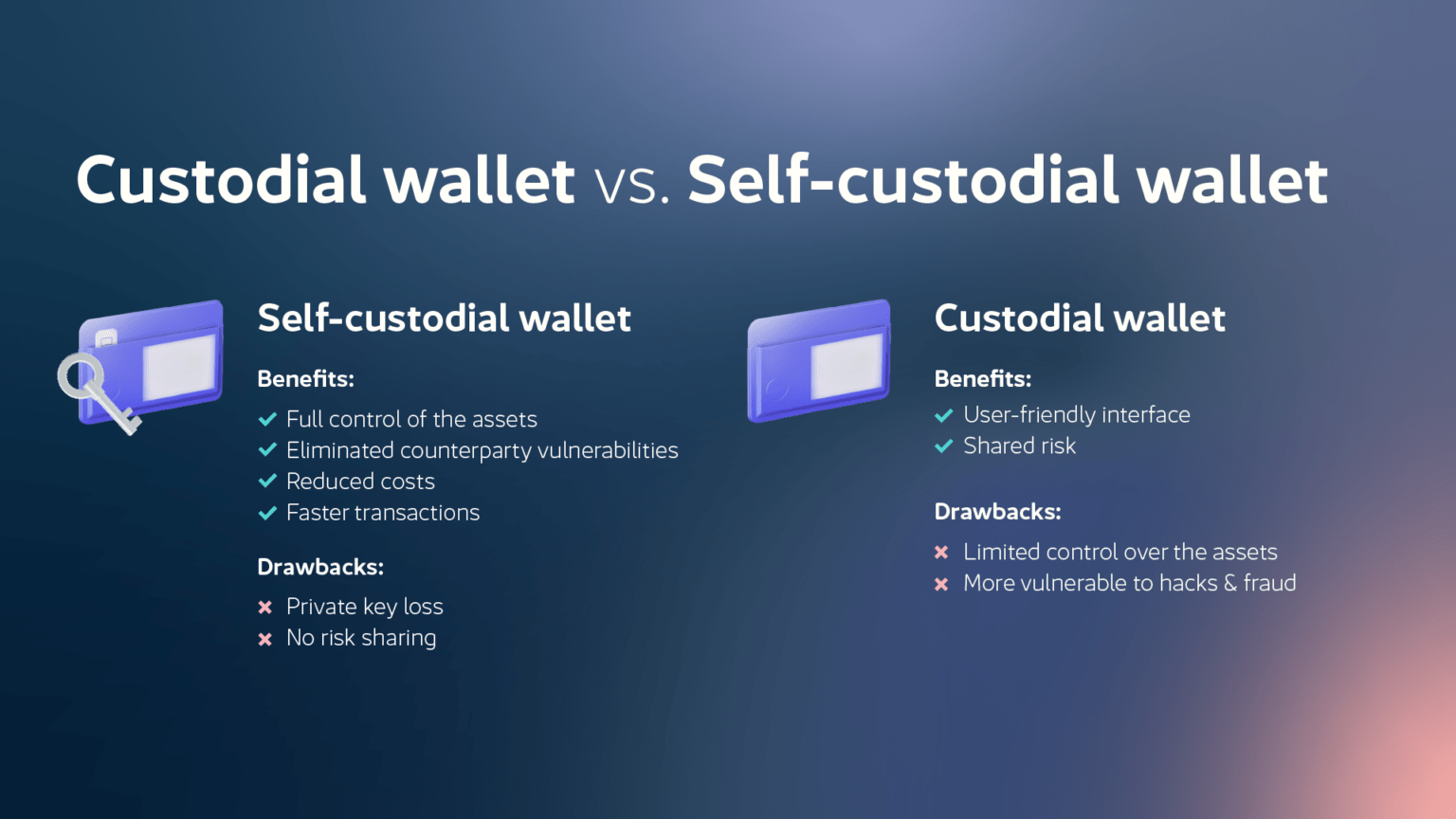

Differences Between Custodial and Self-Custodial Wallets

Exploring the disparities between custodial and self-custodial wallets sheds light on a critical distinction – private key ownership. With custodial wallets, third parties take charge of your keys, requiring you to trust them with your crypto. Effectively, you’re handing over control of your funds to the wallet provider, making you reliant on their services and decisions. Due to this, custodial wallets may offer a streamlined user experience by managing the complexities of blockchain interactions on your behalf, but it comes with a risk.

On the other side, self-custodial wallets give you full control of your private keys. This difference boosts security and control, letting you protect your digital assets on your own. By keeping your private keys, you reduce the risk of hacks and maintain the spirit of decentralized crypto management.

What are examples of self-custodial wallets?

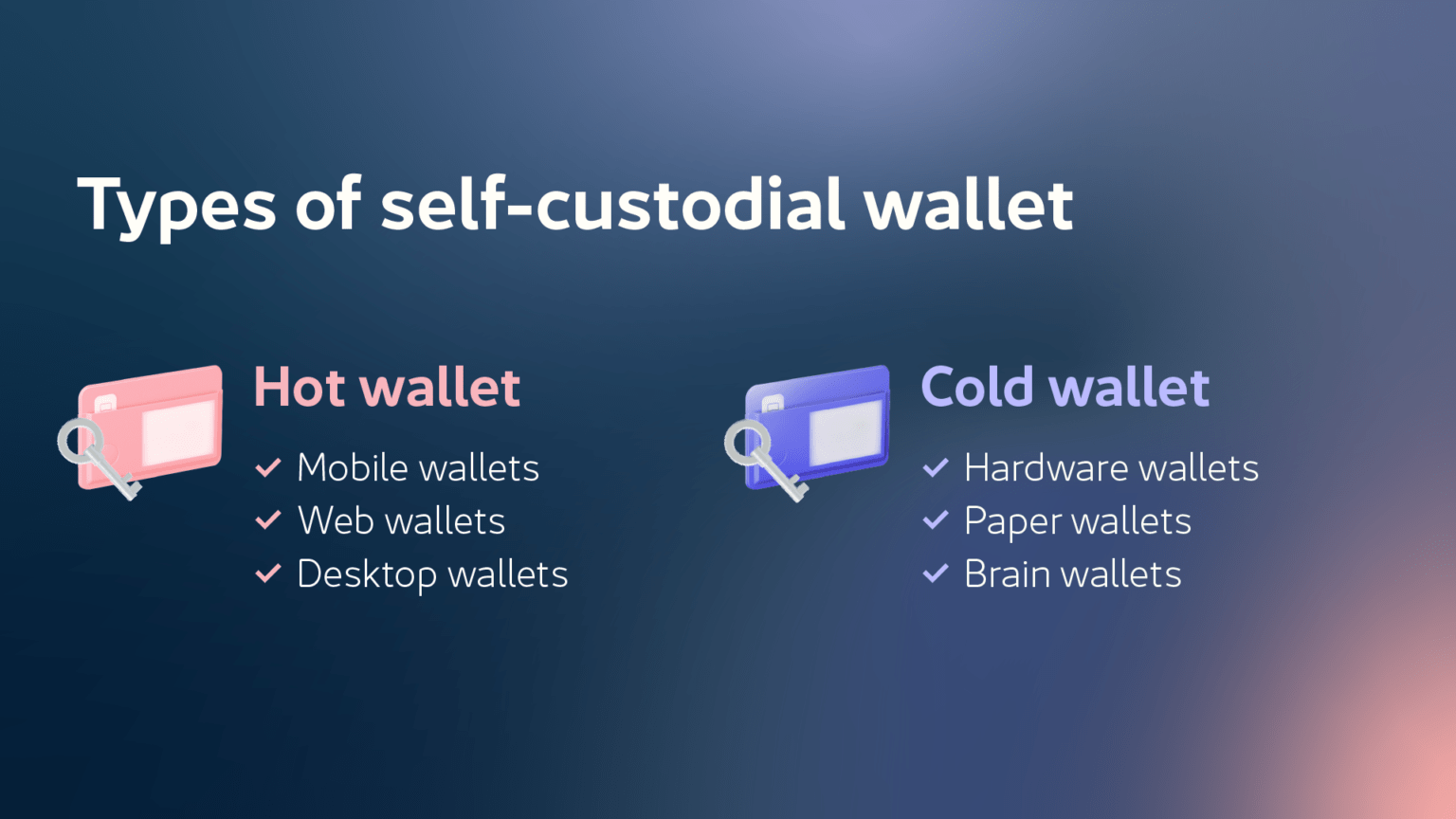

Cryptocurrency wallets are essential tools for managing digital assets, and they come in various forms, primarily categorized as hot wallets and cold wallets. Hot wallets are connected to the internet, making them more accessible but potentially more vulnerable to online threats. Each type of hot wallet offers a unique blend of convenience and security, catering to the different needs and preferences of cryptocurrency users.

Subtypes of hot wallets include mobile wallets, desktop wallets, and web wallets. Mobile wallets are apps installed on smartphones, offering accessibility and convenience for on-the-go users, and this is exactly what the Monitok wallet is. Desktop wallets are software programs installed on computers, providing a balance between accessibility and security. Web wallets, accessible through web browsers, offer ease of use but may be susceptible to online threats such as phishing.

On the other hand, cold wallets are offline storage options, providing an added layer of security by being less susceptible to online hacks. Cold wallet subtypes include hardware wallets, paper wallets, and brain wallets. Hardware wallets are physical devices that store the user’s private keys securely. Paper wallets are physical documents containing the necessary information for accessing and managing digital assets. Brain wallets rely on the user’s ability to memorize a passphrase that generates the private and public keys.

Each wallet type has its advantages and disadvantages, and the choice of wallet depends on individual needs, preferences, and the level of security required.

How to Use a Self-Custody Wallet?

- Account Creation: Begin by signing up for an account on the chosen wallet application. Provide your necessary details and create a secure password.

- Network Selection: After account creation, choose the blockchain network for which you want to create a wallet. Different cryptocurrencies operate on distinct networks (e.g., Ethereum, Binance Smart Chain).

- Seed Key Preservation: Upon selecting the network, you’ll be provided with a unique seed key (recovery phrase). This key is essential for accessing your wallet in case you forget your password or lose device access. Write down the seed key and keep it in a safe, offline place. Never share it with anyone.

- Wallet Access: Once the seed key is secured, your wallet will be generated. You can access your wallet using your account credentials and the seed key. This combination ensures only you have control over your assets.

Monitok Self-Custody wallet

The Monitok platform is engineered with a mobile self-custodial wallet feature, positioning asset holders as the exclusive custodians of their digital wealth. This self-custodial wallet architecture delivers a powerful trio of advantages to Monitok’s user base: fortified security, elevated privacy, and expedited transactions at reduced costs. These attributes render the wallet an essential instrument for the contemporary digital asset trader.

For enhanced convenience aligned with user autonomy, Monitok allows for optional storage of seed phrase in an encrypted, private, secure cloud environment. This ensures that the seed phrase remains both secure and exclusively retrievable by the owner, reducing the risk of losing it. In this way, self-custodial wallets facilitated by hybrid excahnge like Monitok are redefining benchmarks in cryptocurrency trading security.

Is a self-custody wallet safe?

Yes, self-custodial wallets provide enhanced security through direct control of your assets.

Is Monitok a self-custodial wallet?

Yes, Monitok offers one of the best self-custody crypto wallet that empowers users to have complete control over their crypto holdings.

What is the difference between self-custody and custodian?

Self-custody involves owning your private keys, while custodian wallets are managed by third parties.

What are the disadvantages of custodial wallets?

Custodial wallets introduce a reliance on third parties and may compromise privacy.