Etter hvert som kryptolandskapet utvikler seg, dukker hybridkryptobørser opp som frontrunnere. Hvorfor skjer denne transformasjonen?

Kryptovalutaverdenen er i stadig utvikling, og med den kommer behovet for sikre og effektive handelsplattformer. Hybridkryptobørser er en blanding av de beste funksjonene fra både sentraliserte og desentraliserte modeller. Men hva er det som gjør dem til det beste valget for moderne tradere? La oss starte fra begynnelsen 👇

Hva er kryptovaluta-børser?

En kryptovalutabørs, eller en digital valutaveksling, er en virksomhet som gjør det mulig for kunder å bytte kryptovalutaer eller digitale valutaer mot andre aktiva, for eksempel vanlige fiat-penger eller andre digitale valutaer.

Kryptovalutabørser er mer enn bare plattformer for handel med digitale valutaer. De er selve hjertet i kryptoøkosystemet, og dikterer tempoet, likviditeten og verdien av ulike kryptovalutaer.

Typer kryptobørser: Et dypdykk

Sentraliserte kryptobørser (CEX): Hva er en sentralisert børs?

Sentraliserte børser, som Binance og Coinbase, administreres av én enkelt enhet. De er kjent for sine brukervennlige grensesnitt, depotlommebøker og omfattende regelverk.

En sentralisert børs fungerer på samme måte som et konvensjonelt aksjemarked. De fungerer som et mellomledd som kobler sammen kjøpere og selgere, og de anses vanligvis som sikrere og mer pålitelige enn desentraliserte børser. Denne tilliten er tydelig ettersom sentraliserte børser dominerer markedet og håndterer 95% av alle handler.

Funksjoner ved sentraliserte børser

Noen av funksjonene sentraliserte børser har, er

Praktisk brukergrensesnitt for mobil

De tilbyr et brukervennlig mobilgrensesnitt for sømløs handel på farten. Dette sikrer at tradere kan få tilgang til kontoene sine og utføre handler når som helst og hvor som helst, noe som øker fleksibiliteten.

Depotlommebok

En depotlommebok defineres som en lommebok der de private nøklene oppbevares av en tredjepart. Dette betyr at tredjeparten har full kontroll over pengene dine, mens du bare trenger å gi tillatelse til å sende eller motta betalinger.

De tilbyr depotlommebøker som sørger for at brukernes eiendeler forvaltes og lagres på en sikker måte. Dette gir brukerne trygghet, i visshet om at midlene deres er i trygge hender.

Bestillingsbok

Med et ordrebokssystem på plass kan brukerne se kjøps- og salgsordrer i sanntid. Denne funksjonen øker gjennomsiktigheten i handelen, slik at brukerne kan ta informerte beslutninger basert på etterspørselen i markedet.

Bankfunksjoner

De har bankfunksjoner som on/off-ramper, betaling med kort og kryptokredittkort. Dette gjør det enkelt å foreta fiat-til-kryptotransaksjoner, og bygger bro mellom tradisjonell bankvirksomhet og kryptoverdenen.

Utvidede bekvemmelighetsfunksjoner

Sentraliserte sentraler har forbedrede bekvemmelighetsfunksjoner, inkludert kundestøtte og gjenvinning av eiendeler. Disse funksjonene forbedrer brukeropplevelsen og sikrer at brukerne får den støtten de trenger når de trenger den.

Bred tilgjengelighet

Plattformene til sentraliserte børser er designet for bred tilgjengelighet. Enten det er på nett, mobil eller nettleserutvidelser, kan brukerne enkelt få tilgang til kontoene sine og handle på tvers av ulike enheter.

Regulatorisk rammeverk

Sentraliserte børser kjennetegnes av at de følger et regelverk som omfatter KYC, AML, GDPR, finansiell revisjon og forsikring av midler. Regulerte kryptobørser må overholde lover og opprettholde åpenhet i sin finansielle virksomhet. Dette bidrar til stabiliteten i organisasjonen og sikkerheten til individuelle eiendeler og data.

Raskere og billigere enn DEX

Når det gjelder hastighet og kostnader, har sentraliserte børser et fortrinn. Transaksjonene går raskt og til lave kostnader, ettersom de ikke trenger å bruke blokkjeder og ulike nettverk, de kan samle transaksjoner og produsere mer kostnadseffektiv handel.

Men visste du at de kontrollerer de private nøklene til eiendelene du setter inn? Når vi ser på sentraliserte børser kontra desentraliserte børser, er dette et visst tilbakeskritt for sentraliserte børser og en avgjørende fordel for desentraliserte børser.

Desentraliserte børser (DEX): Hva er en desentralisert børs?

En desentralisert kryptovaluta-børs, kjent som DEX, står i kontrast til sin sentraliserte motpart. Den opererer uten et styrende selskap, en enhet eller en person. Transaksjoner på en DEX er direkte peer-to-peer, uten mellomledd, og styres autonomt av algoritmer som kalles smartkontrakter.

Plattformer som Uniswap opererer uten en sentral myndighet. De prioriterer sikkerhet, tillater peer-to-peer-handel og sikrer at brukerne beholder kontrollen over sine private nøkler. Men selv om de tilbyr uovertruffen sikkerhet, kan de noen ganger være mindre intuitive for nye brukere.

DEX-er fungerer på grunnlag av blokkjedeteknologi og krever at brukerne har kryptovaluta-lommebøker for å lagre tokens. Før en transaksjon kan utføres, må disse lommebøkene kobles til børsen. På den annen side fungerer sentraliserte børser på samme måte som banker, og beholder eiendelene dine og sørger for deres sikkerhet.

Funksjonene til desentraliserte børser

La oss se noen av funksjonene til desentraliserte børser:

Ikke-frihetsberøvet lommebok

De prioriterer brukerautonomi ved å tilby lommebøker med selvforvaring ettersom ingen tredjepart har tilgang til nøklene. Dette sikrer at brukerne har full kontroll over sine private nøkler og eiendeler, noe som understreker fullt eierskap og sikkerhet.

Automatisert market maker (AMM)

De benytter ofte automatiserte market makere (AMM) for å sikre likviditet. Dette systemet legger til rette for direkte peer-to-peer-handel, noe som eliminerer behovet for mellommenn og øker effektiviteten i handelen.

Anonym handel

En av de fremtredende egenskapene ved desentraliserte børser er at det ikke er behov for reguleringer som krever KYC og identitetsavsløring om hvem som eier lommeboken.

Ingen regulering

Desentraliserte børser opererer utenfor det tradisjonelle finanstilsynet og er ikke bundet av standardreguleringer. Dette gir en viss frihet, men krever også at brukerne utviser forsiktighet og aktsomhet.

Desentralisert og ingen støtte for brukerne

Disse børsenes desentraliserte natur betyr at de opererer uten et sentralt styringsorgan. Som et resultat av dette mangler de vanligvis sentralisert kundestøtte, noe som gjør at brukerne må navigere og løse problemer på egen hånd.

Ingen Fiat-påkjøringsrampe

Desentraliserte børser er primært kryptofokuserte, noe som betyr at de ofte ikke legger til rette for direkte innskudd eller uttak av fiat-valuta. Dette kan begrense tilgjengeligheten for dem som ønsker å veksle mellom tradisjonelle valutaer og kryptovalutaer.

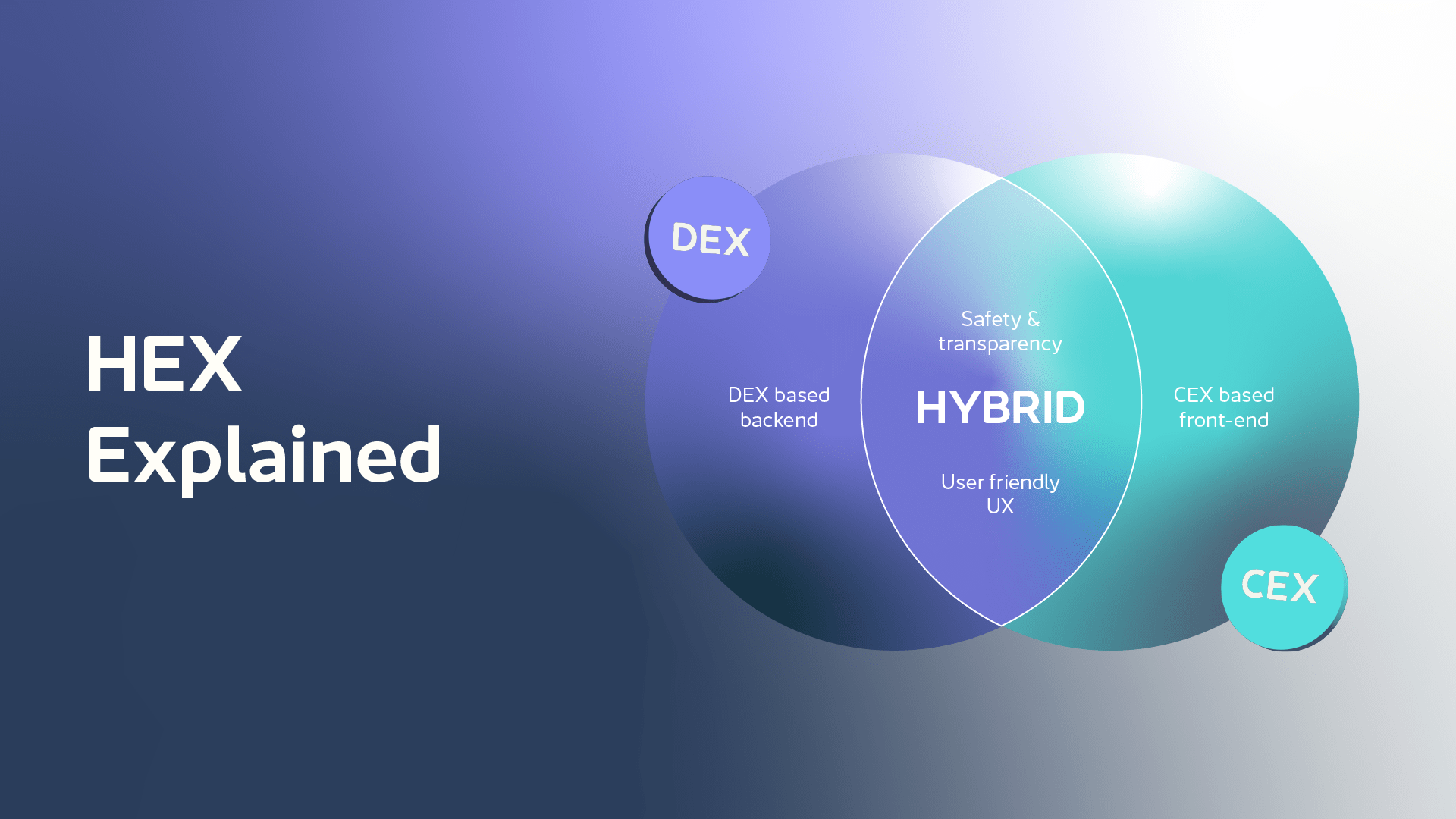

Hybrid kryptobørs (HEX): Hva er en hybrid børs?

Hybridbørser kombinerer funksjoner fra både CEX og DEX plattformer.

De tilbyr brukerne autonomi over eiendelene sine, i likhet med desentraliserte børser, samtidig som de etterstreber hastigheten og brukervennligheten som kjennetegner sentraliserte børser. I tillegg er de utformet for økt skalerbarhet og reduserte transaksjonskostnader.

Hybridplattformer benytter en deponeringsmekanisme for å sikre aktiva under handel, noe som gjenspeiler likviditetstilnærmingen til sentraliserte børser. Dette eliminerer behovet for brukerdrevet likviditet, som er typisk for desentraliserte børser, noe som sikrer raskere transaksjoner og gjør at man unngår de høye avgiftene DEX-er må betale ved lave handelsvolumer.

Hybridbørser utnytter blokkjedeteknologi, og gitt deres fortrinn i forhold til konvensjonelle desentraliserte plattformer, er de klare til å påvirke kryptovalutaområdet betydelig i de kommende årene.

Typer hybridbørser

Typer hybridbørser inkluderer ordrebok-DEXer, automatiserte market makers (AMMer) og DEX-aggregatorer.

Ordrebok DEXer

Ordrebok DEXer på hybridbørser bruker et system der kjøps- og salgsordrer listes opp i sanntid, slik at tradere kan matche direkte med tilgjengelige tilbud, noe som sikrer åpenhet og dybde i handelen. Denne tilnærmingen gjenspeiler tradisjonelle handelsplattformer, men fungerer i et desentralisert miljø.

Automatiserte prisstillere (AMM-er)

Automatiserte market makere (AMM-er) i hybride omgivelser setter og justerer automatisk prisene på kryptovalutaer basert på matematiske formler, noe som eliminerer behovet for ordrebøker. Dette sikrer konstant likviditet og gjør at brukerne kan handle uten å vente på en motpart.

DEX-aggregatorer

DEX-aggregatorer henter inn likviditet fra ulike desentraliserte børser og optimaliserer handelen for brukerne. Ved å skanne flere plattformer sørger de for at tradere får best mulig priser og reduserer glidningen som ofte er forbundet med desentralisert handel.

Funksjoner av hybride kryptobørser

Funksjoner ved hybride kryptobørser inkluderer:

Praktisk grensesnitt

Hybride kryptobørser prioriterer brukeropplevelsen ved å tilby et brukervennlig grensesnitt. Denne designtilnærmingen sikrer at både nybegynnere og erfarne tradere enkelt kan navigere og utføre handler.

Selvforvaltende lommebok

Akkurat som DEXer prioriterer de brukerautonomi ved å tilby lommebøker som ikke er depotbaserte, ettersom ingen tredjepart har tilgang til nøklene. Dette sikrer at brukerne har full kontroll over sine private nøkler og eiendeler, og legger vekt på fullt eierskap og sikkerhet.

Sikkerhet er avgjørende i hybridbørser, og de understreker dette ved å tilby depotlommebøker. Denne funksjonen sikrer at brukernes eiendeler lagres sikkert, noe som gir trygghet i handelsprosessen.

DEX Trading

En av de fremtredende egenskapene til hybridplattformer er deres støtte for DEX-handelsmetoder. Enten det dreier seg om ordrebøker, automatiserte market makere (AMM-er) eller likviditetsaggregering, integrerer hybridbørser disse funksjonene for å tilby en omfattende handelsopplevelse.

Regulering

Hybridbørser anerkjenner viktigheten av tillit og sikkerhet. Derfor følger de spesifikke regulatoriske standarder, og de balanserer mellom å tilby brukerautonomi og å sikre at etablerte finansielle normer overholdes.

Bankfunksjoner

Hybridbørser bygger bro mellom den tradisjonelle finansverdenen og kryptofinansverdenen, og inneholder viktige bankfunksjoner. Med verktøy som on-ramp forenkler de prosessen med fiat-til-kryptotransaksjoner, noe som gjør det enklere for brukerne å veksle mellom ulike finansielle systemer.

Alle typer børser har sine fordeler og ulemper, som alt annet i livet! CEXer og DEXer har imidlertid noen begrensninger sammenlignet med HEXer.

Begrensninger ved CEX og DEX: Derfor er HEX fremtiden

CEX-plattformer er brukervennlige, men de går ofte på akkord med sikkerheten. DEX-er prioriterer derimot sikkerhet, men kan være mindre intuitive.

HEX-plattformer bygger bro over disse hullene, og tilbyr en perfekt blanding av sikkerhet, bekvemmelighet og likviditet. Med funksjoner som forbedret brukerkontroll, robuste sikkerhetstiltak og et bredt spekter av handelsalternativer, er HEX-plattformene klare til å dominere kryptohandelslandskapet.

Sammenlignende analyse: CEX vs. DEX vs. HEX

Brukeropplevelse og bekvemmelighet: HEX-plattformene tilbyr en intuitiv og brukervennlig opplevelse, inkludert kundestøtte, uten at det går på bekostning av sikkerheten.

Kontroll over aktiva og desentralisert handel: I motsetning til CEX-plattformer der aktiva deponeres, sørger HEX for at brukerne beholder kontrollen over sine private nøkler, akkurat som DEX-er.

Effektivitet: HEX-plattformer kombinerer hastigheten til CEX-plattformer med sikkerheten til DEX-plattformer, noe som gir effektiv og sikker handel.

Bankfunksjoner: HEX inkluderer fiat på rampe og av rampe, samtidig som det er regulert og kompatibelt som de fleste finansinstitusjoner.

Her er en oversiktlig sammenligning av alle de tre børstypene:

Fordeler

Sentraliserte kryptobørser

- Støtter fiat-valutaer og digitale valutaer.

- Mer brukervennlig og stabil enn DEX.

- Kundesupport er tilgjengelig.

- Har vanligvis billigere transaksjonsgebyrer.

Desentraliserte kryptobørser

- Ikke regulert, noe som betyr mer frihet.

- Det kreves ingen identitetskontroll, noe som gjør det mulig å handle anonymt.

- Mindre utsatt for markedsmanipulasjon

- Sikrere.

Hybride kryptobørser

- Støtter fiat-valutaer og digitale valutaer.

- Mer brukervennlig enn DEX.

- Bedre skalerbarhet enn DEX, noe som betyr rask behandling selv ved store transaksjonsvolumer.

- Mindre regulering enn CEX.

- Sikkerheten økes ved at eiendelene eies av private.

- Mer likviditet sammenlignet med DEX

Ulemper

Sentraliserte kryptobørser

- Depotlommebok, det vil si at eiendelene ikke tilhører brukerne.

- Ingen eller liten åpenhet om hva som skjer økonomisk med børsen eller eiendelene dine.

- CEX' størrelse og natur gjør det til et enklere mål for hackere.

- Regulert av myndighetene og forpliktet til å fremvise alle økonomiske dokumenter på forespørsel.

Desentraliserte kryptobørser

- Vanskeligere å komme om bord uten forkunnskaper om krypto.

- Støtter ikke fiat-transaksjoner.

- Lite eller ingen brukerstøtte.

- Høyere handelspris sammenlignet med CEX

Hybride kryptobørser

- Mindre personvern enn DEX

Monitok: Leder HEX-revolusjonen

Monitok er en neste generasjons hybrid kryptobørs (HEX) som sømløst integrerer fordelene med både sentraliserte og desentraliserte handelsplattformer. Monitok tilbyr en svært intuitiv mobilapp, og sørger for at brukerne har full kontroll over sine kryptoaktiva, med vekt på fullt eierskap og åpenhet. Monitok har ingen tilgang til private nøkler, og private nøkler/mnemonics forlater ikke appen. Brukerne har muligheten til å lagre den private nøkkelen på et stykke papir, eller de kan velge å lagre en kryptert versjon av den private nøkkelen på sin digitale enhet eller i skyen for enklere gjenoppretting.

Plattformen er en blanding av funksjoner som en innebygd desentralisert lommebok, kryptert gjenoppretting av private nøkler, totrinnsverifisering og biometrisk pålogging. Tradere kan få tilgang til over 100+ kryptotokens på tvers av 98 DEXer i Arbitrum-nettverket, noe som sikrer at de alltid får de beste kursene med minimale gebyrer.

I tillegg tilbyr Monitok innsatsmuligheter med attraktiv avkastning, peer-to-peer-overføringer, fiat on/off-ramper og et kryptodebetkort. Med sin forpliktelse til å kombinere fleksibilitet, pålitelighet og brukersentrerte funksjoner, er Monitok klar til å sette nye standarder i kryptohandelslandskapet.

Monitok er bygget med tanke på fremtiden for hybridhandel, fordi vi tror at hybridbørser er den "neste store greia" innen kryptohandel. Hvorfor? 👇

HEXs ringvirkninger på kryptovaluta

Hybridbørser er mer enn bare plattformer; de endrer spillet. De påvirker handelsstrategier, likviditetsstyring og til og med den fremtidige utviklingen av kryptobørser. Når vi ser fremover, kan ikke HEX-plattformenes betydning og potensial for å forme kryptoverdenen overvurderes.

Med forbedrede HEX-likviditetsløsninger som sikkerhet, bankfunksjoner, likviditet, regelverk og brukeropplevelse og bekvemmelighet, sikrer de optimale handelskurser og raske transaksjoner, noe som gjør dem attraktive for et bredt spekter av tradere.

Hybride kryptobørser er ikke bare en trend; de er fremtiden. Etter hvert som kryptoverdenen fortsetter å utvikle seg, er disse plattformene perfekt posisjonert for å lede an, og tilbyr tradere den perfekte blandingen av sikkerhet og bekvemmelighet.

Er du klar til å dykke ned i HEX-verdenen? Bli med oss på reisen vår 👇

– Bli med i Discord-fellesskapet vårt

– Hold deg oppdatert på Telegram

Ofte stilte spørsmål

Sentraliserte børser (CEX): Disse administreres av sentraliserte organisasjoner eller selskaper. De fungerer som mellomledd mellom kjøpere og selgere, og tilbyr en plattform for handel med kryptovalutaer. Eksempler inkluderer Binance, Coinbase og Kraken.

Desentraliserte børser (DEX): Disse fungerer uten en sentral myndighet og legger til rette for peer-to-peer-handel direkte mellom brukerne. De baserer seg på smartkontrakter og blokkjedeteknologi for å automatisere og sikre transaksjoner. Eksempler på dette er Uniswap, SushiSwap og PancakeSwap.

Hybridbørser (HEX): Disse kombinerer funksjoner fra både sentraliserte og desentraliserte modeller. De har som mål å tilby sikkerheten og brukerkontrollen til DEX-er, samtidig som de gir hastigheten, likviditeten og det brukervennlige grensesnittet til CEX-er.

En HEX kombinerer styrkene til både CEX og DEX. Sammenlignet med sentraliserte vs. desentraliserte børser tilbyr en HEX brukervennligheten og hastigheten til en CEX, samtidig som den beholder sikkerheten og autonomien til en DEX. Når det gjelder desentraliserte børser kontra hybridbørser, gir HEX bedre likviditet og effektivitet uten at det går på bekostning av brukerkontrollen. Og når det gjelder sentraliserte børser kontra hybridbørser, tilbyr begge en strømlinjeformet opplevelse, men HEX sikrer større brukerkontroll over aktiva og desentraliserte funksjoner.

Her er noen eksempler på ulike typer kryptobørser:

CEX: Binance, Coinbase, Kraken

DEX: Uniswap, SushiSwap, PancakeSwap

HEX: Monitok, GRVT, C3

Ved å bruke en HEX får du brukervennligheten til CEX kombinert med sikkerheten til DEX. HEX sikrer optimale handelshastigheter, raskere transaksjoner og større brukerautonomi, samtidig som den ofte overholder regulatoriske standarder, noe som gjør den til et balansert valg for kryptohandel.

De tilbyr bekvemmeligheten til CEX-plattformer og sikkerheten til DEX-plattformer, noe som gjør dem til det ideelle valget for moderne tradere.

Gjennom funksjoner som selvoppbevaring, tofaktorautentisering, kjølelagring, overholdelse av regelverk og regelmessige sikkerhetsrevisjoner.

De fleste HEX-plattformer støtter et bredt spekter av kryptovalutaer, noe som gir tradere enorm fleksibilitet.